For most companies having a good performance track record, undoubtedly successful completion of an initial public offering (“IPO”) represents a significant milestone in the company’s development. Simultaneously, the transition from a private company to a public company also brings forth new challenges in terms of compliance and management for the company itself.

For shareholders and management of a listing applicant, the preparation process for listing is essentially a process of reorganizing the company's management structure and a re-acquaintance with the company itself. Thorough and comprehensive preparation and arrangement can significantly reduce potential obstacles during the application process.

This article mainly focuses on the following core issues in the consideration and preparation of listing for mainland Chinese companies (the "listing applicant") intending to be listed on The Stock Exchange of Hong Kong Limited (the "Stock Exchange").

ANALYSING AND SIMPLIFYING THE EXISTING STRUCTURE

One of the most crucial steps in the pre-IPO preparation stage is determining and refining the company’s listing structure. This includes revisiting the equity structure and streamlining the company’s business operations. In general, for mainland Chinese applicants applying for listing on the Stock Exchange, there are two most common approaches: the first is for the mainland Chinese company to act as the issuer to issue H-shares, and the second is to establish a red-chip structure where an offshore entity (i.e. a special-purpose vehicle) is set up that indirectly controls the onshore operating entities through equity ownership. Separately, for industries where foreign investment is prohibited or restricted, companies may choose to adopt a Variable Interest Entity (“VIE”) structure, where an offshore entity is established to control the onshore operating entities through contractual arrangements. However, the basis on whether the VIE structure may be adopted is typically limited to addressing foreign ownership restrictions.

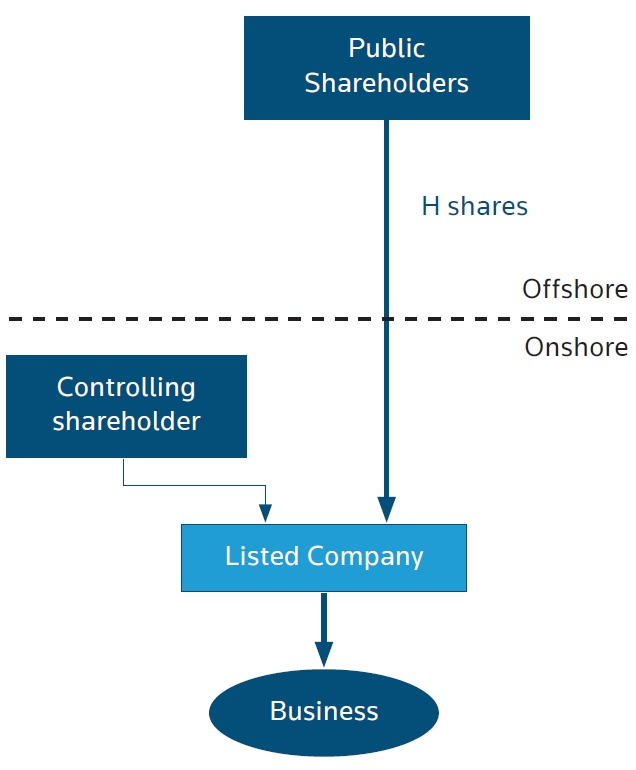

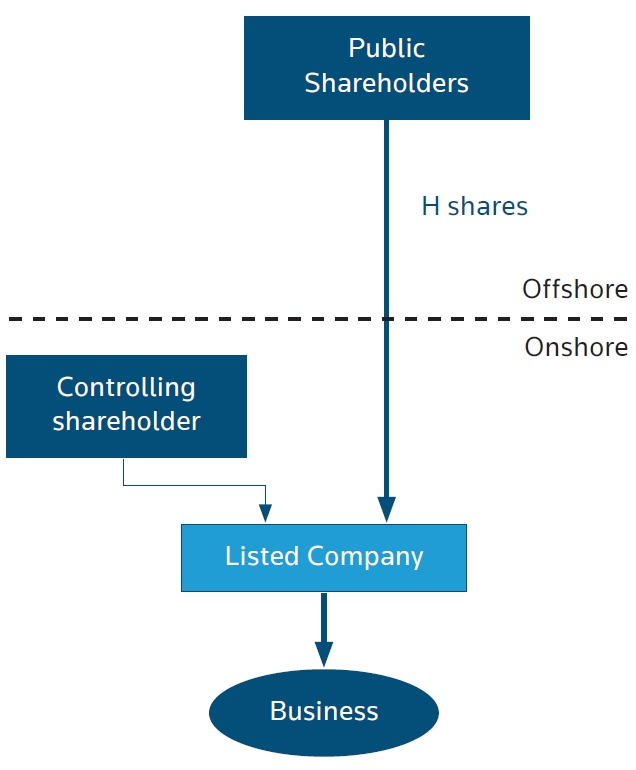

Basic structure of a H-share model

The listed company is a domestic limited liability company registered in China

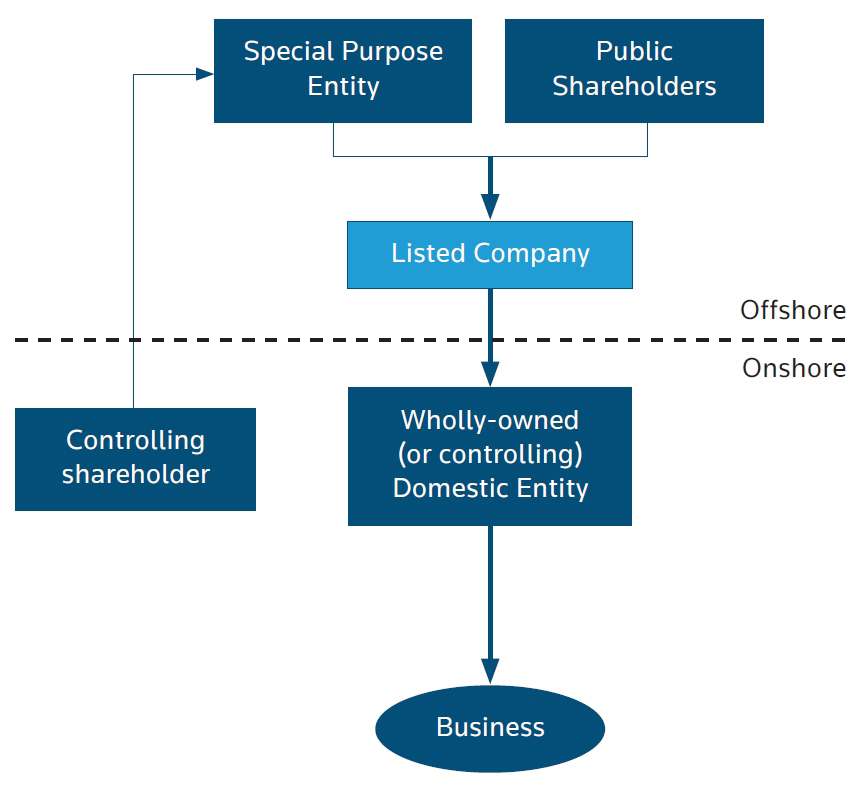

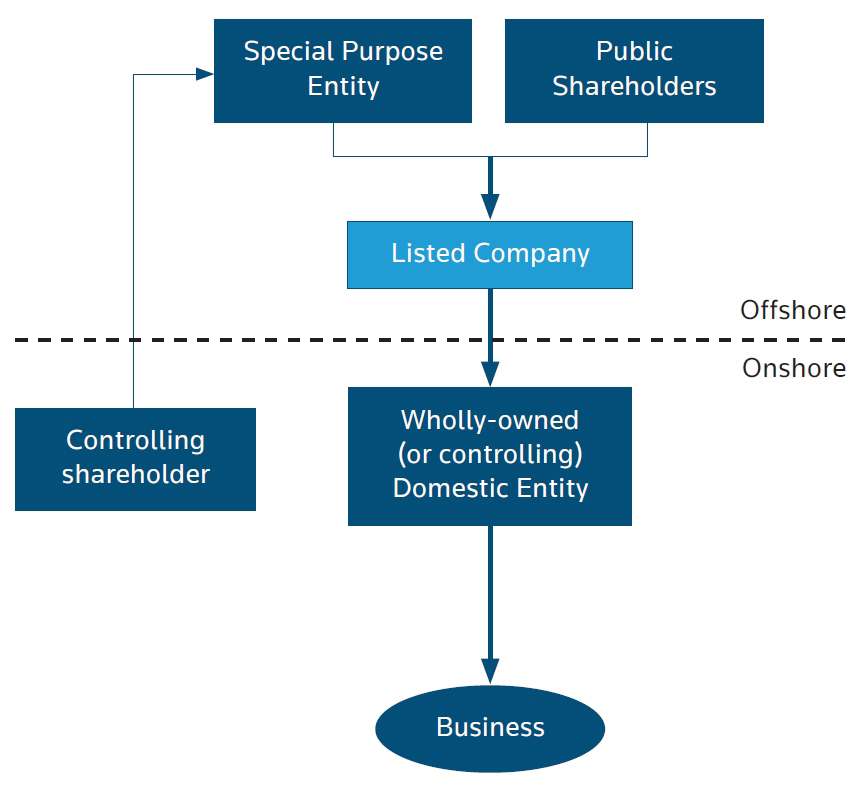

Basic structure of a red-chip model

The listed company is typically an investment holding company registered overseas, often in jurisdictions such as the Cayman Islands or Bermuda.

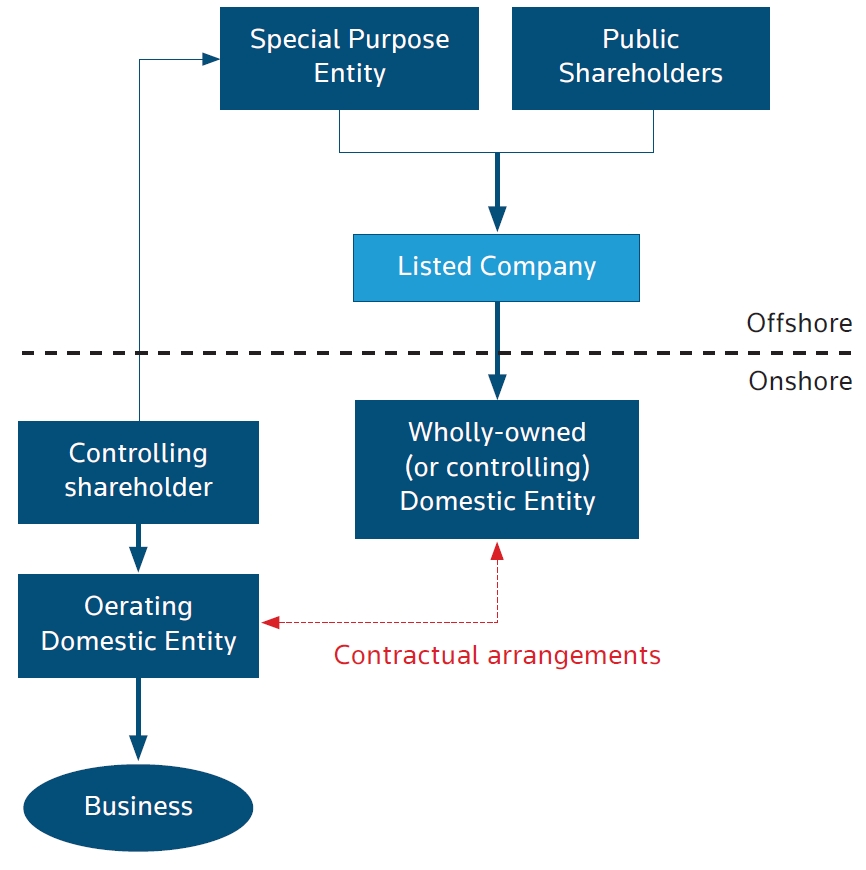

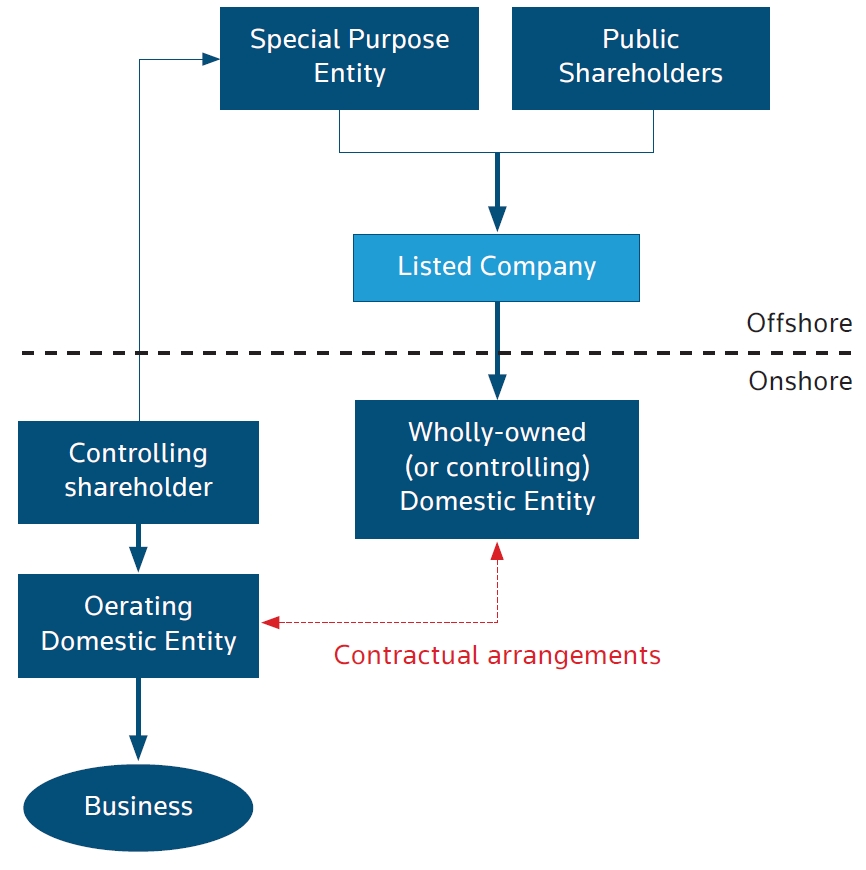

Basic structure of a VIE model

The listed company is an investment holding company incorporated overseas that does not directly own the onshore business but effectively controls it through a series of contractual arrangements.

The restructuring steps involved in the aforementioned equity structures, particularly the red-chip approach, may likely incur additional costs. Therefore, in the process of preparing for an IPO, the sooner the final equity structure is determined, the lower the probability that further adjustments will be required and additional adjustment costs will be incurred.

When considering a VIE listing structure, generally, it is necessary to assess whether the nature of the business intended for listing falls within the scope that requires the establishment of a VIE structure, and whether all business operations are subject to foreign investment restrictions or prohibitions. Apart from considering tax and financial aspects, the choice of any listing structure may impact the future planning of the proposed listing group and potentially impact the size of the IPO.

In addition, when considering the listing structure, most listing applicants need to take into account factors such as the entry timing of different pre-IPO investors entering the intended listed company and the onshore or offshore entities that are involved in the proposed listing structure. The choice of the listing structure may also be affected by the identity of the pre-IPO investors themselves.

In planning for the restructuring, strict compliance with relevant foreign control regulations in mainland China and prompt completion of the necessary registrations are required for individual shareholders of the listing applicant. However, shareholders may also consider establishing an individual or a family trust to hold shares of the listed company, to enable inheritance arrangements and facilitate tax planning.

REVISITING RELATIONSHIP WITH KEY SHAREHOLDERS AND OTHER RELATED PARTIES

During a company's development and in the process of establishing the listing structure,

substantial shareholders (including the controlling shareholder and other substantial shareholders under the Listing Rules of the Stock Exchange (the "Listing Rules")) may enjoy special rights on, for instance, appointing directors, selling shares without limitation, by virtue of shareholders' agreements or articles of association of the company. According to the requirements of Hong Kong Stock Exchange, those special rights may have to be terminated at the time or before listing to ensure protection of the minority shareholders.

Assistance provided by shareholders, particularly the controlling shareholders, to member companies of the proposed listing group, whether financial, operational or managerial, also requires further review and monitoring as the listing applicant needs to prove that it can be independent of the controlling shareholders in terms of financial, operational and other aspects. A more common scenario is where the controlling shareholder provides guarantees for a loan granted to a member company of the proposed listing group, and such guarantees need to be discharged or replaced by other guarantors or collaterals either at the time of listing or prior to listing.

In regard to the relationship between the substantial shareholders and other related parties, it is also necessary to examine the role of the relevant shareholder acting as a major customer, major supplier or other roles relating to the business operations of the listing applicant. If to a certain extent, the listing applicant's business operations rely on the support of such shareholder and the relevant business may be regarded as a connected transaction, in addition to scrutinizing whether the relevant transaction is entered into on arm's-length basis, it is also necessary to calculate the proportion of the relevant transaction in the overall revenue and operations, and to evaluate whether the independence of the listing applicant will be affected to a greater extent. Furthermore, if the controlling shareholder holds businesses other than in the proposed listing group that are in the same industry or of similar business nature, it is necessary to assess whether there is any substantive competition and whether there is a need to consolidate such relevant businesses. Therefore, prior to the listing application, a thorough appraisal of the relationship between the substantial shareholders and the related parties as well as the nature of the relevant businesses are important parts of the preparation for listing.

DESIGNING THE RIGHT CORPORATE GOVERNANCE STRUCTURE

When preparing an application for listing in Hong Kong, apart from meeting the financial requirements and continuity of control under the Listing Rules, the listing applicant will also need to look at the continuity of the relevant management and the composition of the board of directors. The identification and selection of directors are of particular importance. Firstly, the Listing Rules require the directors to have skills appropriate to their roles as directors and are able to act prudently and diligently. In particular, executive directors are usually persons having sufficient experience in the industry who are responsible for and actually involved in the management of the listing applicant's business. Secondly, in addition to ensuring no significant changes in the composition of the board of directors over the track record period, diversity of the directors, such as ethnicity, gender, and age, is a factor in reviewing the reasonableness of the corporate governance structure. Finally, the Listing Rules have specific requirements in relation to the background of some directors and the composition of the board, including that the listing applicant must ensure that at least three independent nonexecutive directors comprising at least one-third of the board are appointed, and that at least one of the independent non-executive directors must be suitably qualified in a professional capacity or have appropriate accounting or related financial management expertise.

In accordance with the corporate governance requirements under the Listing Rules, the listing applicant should establish various board committees, which include a remuneration committee, an audit committee and a nomination committee. Depending on the nature of the listing applicant's business and past compliance, different types of committees, such as a risk committee, corporate governance committee, investment committee and strategy committee, may also be required. A sound governance structure should be combined with an effective internal control system to ensure that a healthy and reasonable governance structure is in place at the time of the listing application.

DETERMINING THE APPROPRIATE OFFERING STRUCTURE

The offering structure, which is usually made at a later stage of the listing application, will be determined by the listing applicant and the underwriting team, taking into account the prevailing market conditions, the state of the listing applicant's industry and the listing applicant's own financial performance. The size of the offering will also be related to a number of factors such as the financing requirements and share allocation ratio. In addition, the listing applicant will need to consider the ratio of shares to be held by the public and the minimum issuance size as required under the Listing Rules. In preparation for a listing, identifying the funding gap and the use of the proceeds is the first step in planning a future listing.

DESIGNING THE EMPLOYEE STOCK OPTION PLAN

One of the advantages of a public offering is that it provides greater scope and possibilities for the realization and appreciation of equity, and core employees can easily align their individual interests with the overall interests of the entire listing applicant group through a pre-IPO share incentive plan, which has become an effective means of retaining talent and stimulating growth.

Employee share incentive schemes usually involve the granting of company shares or options to purchase shares in the future to core employees at no cost or at a price significantly lower than the issue price. In preparation for a listing, apart from considering the circumstances of controlling shareholders and potential investors, the structuring of the employee share incentive scheme and the specific arrangements involving individual core employees need to be integrated with the overall structural reorganization.

LISTING CONSIDERATIONS

An important issue in considering listing is the choice of listing venue. The Stock Exchange is one of the most popular listing exchanges in the world, with a well-established, international and transparent regulatory regime, as well as a diversified investor base and a high degree of liquidity of capital, all of which are attractive factors to listing applicants. At the same time, an increasing number of mainland Chinese enterprises and other multinational corporations are choosing Hong Kong as one of their listing venues in addition to listing on the stock exchanges of other countries or regions simultaneously or subsequently.

For example, for a listing applicant issuing H-shares under the structuring arrangement mentioned above, as the listing entity is still a mainland Chinese company, it can conduct an A-share issuance in mainland China by the same listing entity at the same time or in the future without incurring extra restructuring costs. In addition, in dual listing, it is possible to have both a primary and secondary listing in Hong Kong, and the requirements and obligations under the Listing Rules for secondary listing are relatively lower than those with a primary listing.

In summary, consideration of listing generally requires a comprehensive assessment of the specific conditions of the enterprise's development and whether it meets the basic requirements for listing application. After determining the intention to list, the pre-listing process usually involves the planning of the enterprise's future shareholding structure, fine tuning of the existing shareholding and business, the setting up of a governance structure, and designing the structure in relation to investors, employees and future issuance of the shares. With the Stock Exchange actively promoting new sectors such as Special Purpose Venture (SPV) companies and Specialized Technology Venture (STV) companies, it is believed that different types of applicants will have the possibility of listing in Hong Kong in the future. For applicants preparing for a listing application, a comprehensive arrangement and thorough preparation will be the first step to their success.

For shareholders and management of a listing applicant, the preparation process for listing is essentially a process of reorganizing the company's management structure and a re-acquaintance with the company itself. Thorough and comprehensive preparation and arrangement can significantly reduce potential obstacles during the application process.

This article mainly focuses on the following core issues in the consideration and preparation of listing for mainland Chinese companies (the "listing applicant") intending to be listed on The Stock Exchange of Hong Kong Limited (the "Stock Exchange").

ANALYSING AND SIMPLIFYING THE EXISTING STRUCTURE

One of the most crucial steps in the pre-IPO preparation stage is determining and refining the company’s listing structure. This includes revisiting the equity structure and streamlining the company’s business operations. In general, for mainland Chinese applicants applying for listing on the Stock Exchange, there are two most common approaches: the first is for the mainland Chinese company to act as the issuer to issue H-shares, and the second is to establish a red-chip structure where an offshore entity (i.e. a special-purpose vehicle) is set up that indirectly controls the onshore operating entities through equity ownership. Separately, for industries where foreign investment is prohibited or restricted, companies may choose to adopt a Variable Interest Entity (“VIE”) structure, where an offshore entity is established to control the onshore operating entities through contractual arrangements. However, the basis on whether the VIE structure may be adopted is typically limited to addressing foreign ownership restrictions.

Basic structure of a H-share model

The listed company is a domestic limited liability company registered in China

Basic structure of a red-chip model

The listed company is typically an investment holding company registered overseas, often in jurisdictions such as the Cayman Islands or Bermuda.

Basic structure of a VIE model

The listed company is an investment holding company incorporated overseas that does not directly own the onshore business but effectively controls it through a series of contractual arrangements.

The restructuring steps involved in the aforementioned equity structures, particularly the red-chip approach, may likely incur additional costs. Therefore, in the process of preparing for an IPO, the sooner the final equity structure is determined, the lower the probability that further adjustments will be required and additional adjustment costs will be incurred.

When considering a VIE listing structure, generally, it is necessary to assess whether the nature of the business intended for listing falls within the scope that requires the establishment of a VIE structure, and whether all business operations are subject to foreign investment restrictions or prohibitions. Apart from considering tax and financial aspects, the choice of any listing structure may impact the future planning of the proposed listing group and potentially impact the size of the IPO.

In addition, when considering the listing structure, most listing applicants need to take into account factors such as the entry timing of different pre-IPO investors entering the intended listed company and the onshore or offshore entities that are involved in the proposed listing structure. The choice of the listing structure may also be affected by the identity of the pre-IPO investors themselves.

In planning for the restructuring, strict compliance with relevant foreign control regulations in mainland China and prompt completion of the necessary registrations are required for individual shareholders of the listing applicant. However, shareholders may also consider establishing an individual or a family trust to hold shares of the listed company, to enable inheritance arrangements and facilitate tax planning.

REVISITING RELATIONSHIP WITH KEY SHAREHOLDERS AND OTHER RELATED PARTIES

During a company's development and in the process of establishing the listing structure,

substantial shareholders (including the controlling shareholder and other substantial shareholders under the Listing Rules of the Stock Exchange (the "Listing Rules")) may enjoy special rights on, for instance, appointing directors, selling shares without limitation, by virtue of shareholders' agreements or articles of association of the company. According to the requirements of Hong Kong Stock Exchange, those special rights may have to be terminated at the time or before listing to ensure protection of the minority shareholders.

Assistance provided by shareholders, particularly the controlling shareholders, to member companies of the proposed listing group, whether financial, operational or managerial, also requires further review and monitoring as the listing applicant needs to prove that it can be independent of the controlling shareholders in terms of financial, operational and other aspects. A more common scenario is where the controlling shareholder provides guarantees for a loan granted to a member company of the proposed listing group, and such guarantees need to be discharged or replaced by other guarantors or collaterals either at the time of listing or prior to listing.

In regard to the relationship between the substantial shareholders and other related parties, it is also necessary to examine the role of the relevant shareholder acting as a major customer, major supplier or other roles relating to the business operations of the listing applicant. If to a certain extent, the listing applicant's business operations rely on the support of such shareholder and the relevant business may be regarded as a connected transaction, in addition to scrutinizing whether the relevant transaction is entered into on arm's-length basis, it is also necessary to calculate the proportion of the relevant transaction in the overall revenue and operations, and to evaluate whether the independence of the listing applicant will be affected to a greater extent. Furthermore, if the controlling shareholder holds businesses other than in the proposed listing group that are in the same industry or of similar business nature, it is necessary to assess whether there is any substantive competition and whether there is a need to consolidate such relevant businesses. Therefore, prior to the listing application, a thorough appraisal of the relationship between the substantial shareholders and the related parties as well as the nature of the relevant businesses are important parts of the preparation for listing.

DESIGNING THE RIGHT CORPORATE GOVERNANCE STRUCTURE

When preparing an application for listing in Hong Kong, apart from meeting the financial requirements and continuity of control under the Listing Rules, the listing applicant will also need to look at the continuity of the relevant management and the composition of the board of directors. The identification and selection of directors are of particular importance. Firstly, the Listing Rules require the directors to have skills appropriate to their roles as directors and are able to act prudently and diligently. In particular, executive directors are usually persons having sufficient experience in the industry who are responsible for and actually involved in the management of the listing applicant's business. Secondly, in addition to ensuring no significant changes in the composition of the board of directors over the track record period, diversity of the directors, such as ethnicity, gender, and age, is a factor in reviewing the reasonableness of the corporate governance structure. Finally, the Listing Rules have specific requirements in relation to the background of some directors and the composition of the board, including that the listing applicant must ensure that at least three independent nonexecutive directors comprising at least one-third of the board are appointed, and that at least one of the independent non-executive directors must be suitably qualified in a professional capacity or have appropriate accounting or related financial management expertise.

In accordance with the corporate governance requirements under the Listing Rules, the listing applicant should establish various board committees, which include a remuneration committee, an audit committee and a nomination committee. Depending on the nature of the listing applicant's business and past compliance, different types of committees, such as a risk committee, corporate governance committee, investment committee and strategy committee, may also be required. A sound governance structure should be combined with an effective internal control system to ensure that a healthy and reasonable governance structure is in place at the time of the listing application.

DETERMINING THE APPROPRIATE OFFERING STRUCTURE

The offering structure, which is usually made at a later stage of the listing application, will be determined by the listing applicant and the underwriting team, taking into account the prevailing market conditions, the state of the listing applicant's industry and the listing applicant's own financial performance. The size of the offering will also be related to a number of factors such as the financing requirements and share allocation ratio. In addition, the listing applicant will need to consider the ratio of shares to be held by the public and the minimum issuance size as required under the Listing Rules. In preparation for a listing, identifying the funding gap and the use of the proceeds is the first step in planning a future listing.

DESIGNING THE EMPLOYEE STOCK OPTION PLAN

One of the advantages of a public offering is that it provides greater scope and possibilities for the realization and appreciation of equity, and core employees can easily align their individual interests with the overall interests of the entire listing applicant group through a pre-IPO share incentive plan, which has become an effective means of retaining talent and stimulating growth.

Employee share incentive schemes usually involve the granting of company shares or options to purchase shares in the future to core employees at no cost or at a price significantly lower than the issue price. In preparation for a listing, apart from considering the circumstances of controlling shareholders and potential investors, the structuring of the employee share incentive scheme and the specific arrangements involving individual core employees need to be integrated with the overall structural reorganization.

LISTING CONSIDERATIONS

An important issue in considering listing is the choice of listing venue. The Stock Exchange is one of the most popular listing exchanges in the world, with a well-established, international and transparent regulatory regime, as well as a diversified investor base and a high degree of liquidity of capital, all of which are attractive factors to listing applicants. At the same time, an increasing number of mainland Chinese enterprises and other multinational corporations are choosing Hong Kong as one of their listing venues in addition to listing on the stock exchanges of other countries or regions simultaneously or subsequently.

For example, for a listing applicant issuing H-shares under the structuring arrangement mentioned above, as the listing entity is still a mainland Chinese company, it can conduct an A-share issuance in mainland China by the same listing entity at the same time or in the future without incurring extra restructuring costs. In addition, in dual listing, it is possible to have both a primary and secondary listing in Hong Kong, and the requirements and obligations under the Listing Rules for secondary listing are relatively lower than those with a primary listing.

In summary, consideration of listing generally requires a comprehensive assessment of the specific conditions of the enterprise's development and whether it meets the basic requirements for listing application. After determining the intention to list, the pre-listing process usually involves the planning of the enterprise's future shareholding structure, fine tuning of the existing shareholding and business, the setting up of a governance structure, and designing the structure in relation to investors, employees and future issuance of the shares. With the Stock Exchange actively promoting new sectors such as Special Purpose Venture (SPV) companies and Specialized Technology Venture (STV) companies, it is believed that different types of applicants will have the possibility of listing in Hong Kong in the future. For applicants preparing for a listing application, a comprehensive arrangement and thorough preparation will be the first step to their success.