The Exchange recently published its conclusions for the two market consultations made in June 20171 and released a further consultation on Emerging and Innovative Companies in February 20182 , in which several amendments to the Listing Rules have been adopted, and 3 new chapters of Listing Rules for pre-revenue biotech companies, weighted voting rights and secondary listing are proposed3.

These conclusions reflected the Exchange's objectives to (1) address market and regulatory concerns regarding the quality of GEM issuers; and (2) to increase the competitiveness of Hong Kong's exchange market. Amendments to Listing Rules, as well as proposal to create new chapters to the Listing Rules were made.

This article summarizes the most up-to-date listing criteria and explores relevant practical issues for listing applications made to the Exchange after the change of listing regime in Hong Kong.

Key Changes to the Listing Rules

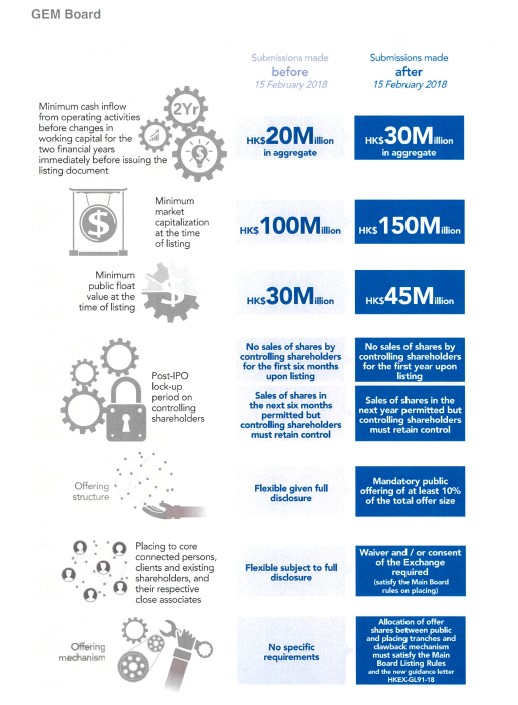

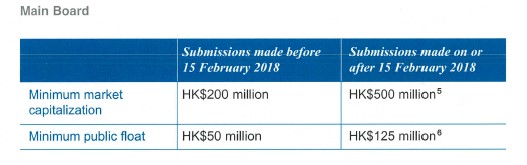

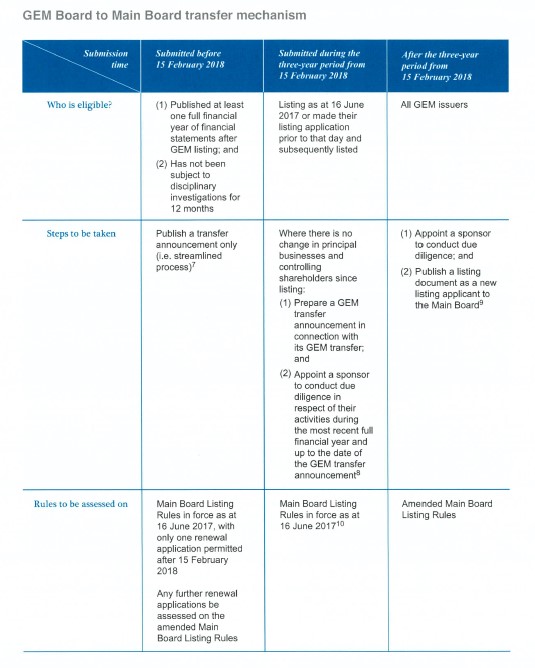

The Exchange4 adopted most of the proposed amendments concerning eligibility and transfer of listing. The table below summarizes the key changes to the Listing Rules that became effective since 15 February 2018.

The criteria for listing on GEM is uplifted, and a longer lock- up period for controlling shareholders and making of public offering is now required, so as to reduce the volatility of stock prices.

The profit test remains unchanged. In other words, the profit attributable to shareholders is at least HK$50 million in the last three financial years (with profits of at least HK$20 million recorded in the most recent year, and aggregate profits of at least HK$30 million recorded in the previous two years). Nevertheless, by raising the stakes for listing on the Main Board, the Exchange is in essence further enhancing the status, attractiveness and minimum market value of the Main Board issuers.

Unless being an eligible GEM issuer to make transfer announcement during the transitional period, an IPO-like application is now required on transfer application, which further reinforces the re-positioning of GEM as a standalone trading board.

Other New Thoughts of the Exchange

On top of reforming GEM, the Exchange further proposed some new changes in response to the new market trends.

Weighted Voting Rights and Pre-revenue of "New Economy" Enterprises

Weighted voting rights ("WVR"), normally allow either certain shareholders to exercise more power over decisions in a company, or certain management to exercise certain powers (in particular the power to commit and appoint directors that would be normally available to shareholders) without holding shares. In Hong Kong, public companies are prohibited from having WVR so as to ensure that all shareholders are treated fairly and equally, the Listing Rules here also recognised such principle11. This reflects the old view of what constitutes the best protection of shareholders' interests, as class action is not available in Hong Kong's courts, and shareholders are unlikely to be effectively remedied under statutory derivative actions. However, the market has evolved over the years in Hong Kong and overseas, particularly among Fintech firms where WVR is becoming more and more popular. It is generally believed that Hong Kong's refusal in allowing WVR forced Alibaba to seek alternative listing in the United States12.

The Exchange sought public opinions over the feasibility of expanding the current listing regime. Feedbacks showed strong views both for and against WVR. Professional bodies generally accepted WVR, but stressed the need for specific criteria to prevent exploitation by those enjoying the 'special rights'.

In its conclusion13, the Exchange proposes to introduce new chapters to the Main Board Listing Rules to allow WVR for eligible innovative tech companies with an expected market capitalization of at least HK$10 billion. Those with a market cap of less than HK$40 billion will also be required to have at least HK$1 billion of revenue in its most recent audited financial year14. In addition, the Exchange further proposes to allow the listing of pre-revenue companies with a minimum expected market capitalization of HK$1.5 billion15. Considering the potential risks, the Exchange first proposes only to permit Biotech companies to list under such new Chapter. This also applies to secondary listing of companies from innovative sectors that are primary listed on New York Stock Exchange or on the premium listing segment of the Main Market of the London Stock Exchange ("Qualifying Exchange")16.

In February 2018, further particulars on listing of Biotech, WVR and secondary listing were made in a market consultation17. Biotech companies are proposed to have at least one pre-I PO investor which is a Sophisticated lnvestor18 and adopt a special marker (B) for its stock code19. Moreover, there must be at least one core product beyond the concept stage, it must be primarily engaged in R&D of its core products for a minimum of 12 months, and the primary reason for listing is to raise capital for the core product, etc20. For WVR issuers, who to be marked (W) in its stock code21, there is a minimum floor and maximum capacity for economic interests held by WVR parties of 10%-50%22. At listing, beneficiaries of the weighted voting rights are proposed to be directors only.23 There are also corporate governance such as training requirements proposed for WVR issuers.24 For secondary listing companies, it is proposed that Greater China companies primarily listed on a Qualifying Exchange on or before 15 December 2017, and companies outside the Greater China listed on a Qualifying Exchange can seek secondary listing in Hong Kong with their existing WVR structures and Variable Interest Entity structures25. The new chapters of the Listing Rules and the new guidance letters regarding Biotech, WVR and secondary listing became effective on 30 April 2018, and companies in emerging and innovative sectors seeking to list under the new regime may now submit formal listing applications.

From the above, it can be seen that the Exchange has adopted a gradual approach, and only a very limited number of companies (in particular, mega-tech companies which have been listed on other reputable exchanges) will benefit from the proposed amendments. It is expected that the proposed new chapters will become effective in the second quarter of 2018, and eligible applicants can then apply26. The market will wait and see if this kind of WVR or pre-revenue "exception" will expand and be open to issuers of smaller scale.

Trends in Suitability for Listing

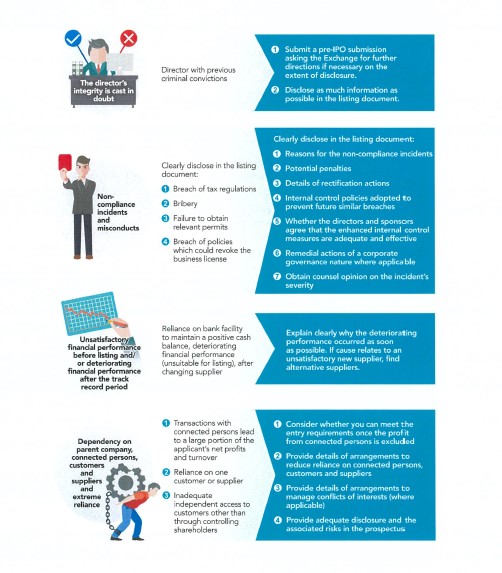

In addition to meeting the above new listing requirements, suitability for listing is also a key consideration of the Exchange when assessing an application. The Exchange has broad discretion in exercising its judgments and the following is a summary of some focal points commonly considered by the Exchange.

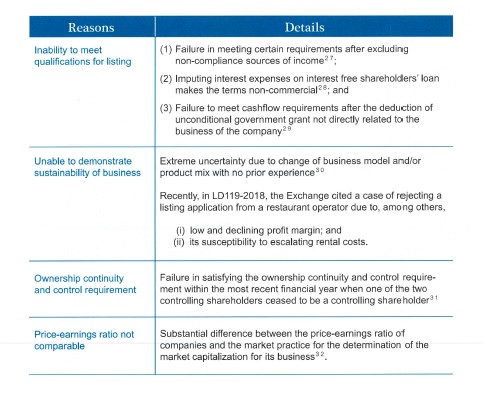

Recent cases of rejection

There are some listing applications being rejected, and some of the reasons for such rejections are summarized here as pitfalls to avoid.

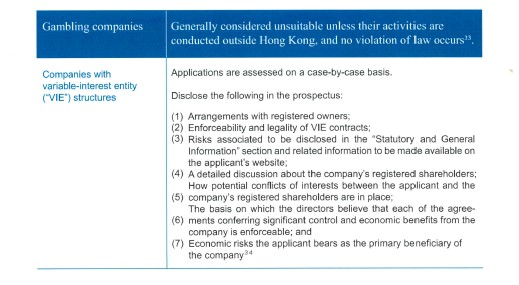

Industries and corporate structure specific

Below are some points to note which are specific to certain industries and corporate structure.

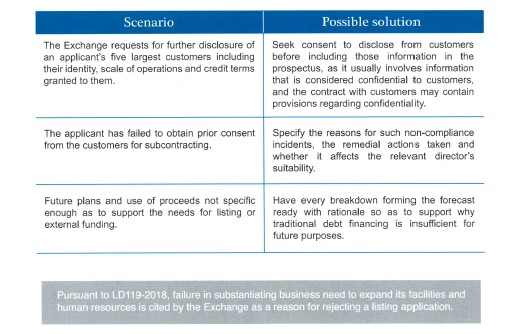

Queries often raised by the Exchange after submission of A1/5A applications

Below are some of the questions frequently asked by the Exchange upon review of listing applications:

Conclusion

So, in view of a more stringent requirement for listing, what do companies need to demonstrate in order to convince the Exchange that it is suitable for listing?

Firstly, it is important to describe clearly what the listing proceeds are intended for. This can be done by formulating a detailed business plan and comprehensive analysis of business operations to show that growth is expected. Where low profit and revenue growth occur, the company needs to satisfy the Exchange with substantial information that the business is sustainable.

Secondly, for those in a declining industry, the applicant needs to prove that it has the resources to

modify its business to respond to the changing demands of the market and justify that the returns from the business would justify the cost of listing35.

Thirdly, companies should find shareholders and directors of good reputation, and disclose possible breaches as soon as possible or submit a pre-lPO enquiry to the Exchange when in doubt. Generally, the longer the period after the non-compliance issue, the higher the chance that it can be successful for listing.

For potential WVR and new-economy applicants, it remains to be seen if the Exchange will further extend the new regime, probably depends on how the market responds to the new chapter issuers.

Listing is both an art and a science, and early identification of relevant issues is important, as accounting, personnel, taxation and legal issues may cause unnecessary delays in the listing process. Applicants should therefore discuss with their lawyers and sponsors, as each case is determined on its own facts and merits.

Sources:

• Hong Kong IPO-A Practical Guide

• A Practical Handbook to Hong Kong IPOs 2017

• Compliance and Company Secretarial Practice of Hong Kong Listed Companies

• The SFC website

• The HKEX website

• Company Law in Hong Kong - Practice and Procedure 2018

1. The proposals were based on whether or not to implement a third board in Hong Kong, in addition to the current GEM and Main Boards, and whether or not to change its listing criteria for the Main and GEM Board. The two consultations were: The Review of the Growth Enterprise Market (GEM) and Changes to the GEM and Main Board Listing Rules, and the New Board Concept Paper.

2. Consultation Paper - A Listing Regime For Companies From Emerging and Innovative Sectors (2018).

3. Ibid.

4. Consultation Conclusions -The Review of the Growth Enterprise Market (GEM) and Changes to the GEM and Main Board Listing Rules (2018).

5. Ibid p.19-21

6. Ibid

7. Ibid

8. Ibid

9. Ibid

10. Even to those who are required to publish a listing document due to change(s) in principal business and/or controlling shareholder since listing, unless it is an eligible GEM issuer which can make transfer announcement during the transitional period, an IPO-like listing application is now required for transfer to the Main Board, which makes, GEM a 'stand-alone' board instead of a 'stepping-stone' board.

11. Listing Rule 2.03(4) and Listing Rule 8.11 prohibits weighted voting rights

12. www.hkex.com .hk/-/media/HKEX-Market/News/News-Release/2015/1506192news.pdf

13. Consultation Conclusions: New Board Concept paper

14. Ibid p.50

15. Ibid p.48

16. Ibid p.13

17. Consultation Paper -A Listing Regime For Companies From Emerging and Innovative Sectors (2018).

18. Ibid p.8

19. Ibid p.1-17

20. Ibid p.8

21. Ibid p.1-11

22. Ibid p.13

23. Ibid p.13

24. Ibid 18-111

25. Ibid p.16

26. Exchange webinar on 23 February 2018

27. HKEX-LD107-2017

28. Ibid

29. HKEX-LD107-2017

30. HKEX-LD107-2017

31. HKEX-LD107-2017

32. HKEX-LD107-2017

33. HKEX-RL25-09

34. HKEX-LD43-3

35. HKEX-GL68-13A